Introduction: Understanding the Carrdus School VAT Hike Closure

The carrdus school vat hike closure has become one of the most significant educational stories in Oxfordshire, drawing national attention for the way it reflects the growing pressures on independent schools. Many families, educators, and policy analysts were stunned at the speed with which the situation unfolded, turning what seemed like a manageable challenge into a complete shutdown. For parents who trusted the school’s long-standing stability, the announcement arrived like an unexpected shock, prompting urgent questions about the underlying causes.

As the closure gained media coverage, it quickly became clear that this event was more than an isolated incident; it was a symbol of wider tensions surrounding the VAT increase on private school fees. Communities across the region began to debate how this policy shift had tipped the balance for smaller institutions. The carrdus school vat hike closure has therefore become a central example of how financial policies can reshape the educational landscape, affecting children, staff, and local families all at once.

Background: The History and Significance of Carrdus School

Carrdus School had a long-established reputation for providing a nurturing, high-quality educational environment with strong community ties. Located within a picturesque rural setting, it offered an inspiring and personalised learning experience that attracted families from across Oxfordshire and neighbouring counties. The school’s heritage included decades of academic success and a proud record of preparing pupils for leading secondary schools, further boosting its credibility and value within the independent sector.

Because of this rich history, the carrdus school vat hike closure came as a painful blow for many who viewed the institution as a community pillar. Staff, parents, and former pupils highlighted the school’s unique role in shaping academic pathways and supporting children through their formative years. For them, the closure represents not only a financial loss but also the end of a cherished chapter in the region’s educational history.

VAT Policy Explained: What Changed and Why It Matters

The government’s decision to apply VAT to private school fees marked a major turning point for the entire independent education sector. For families already stretching budgets to afford fees, even a moderate percentage increase could drastically alter financial planning. This change created immediate uncertainty, and for smaller schools with tightly balanced budgets, it introduced a new level of strain that proved difficult to absorb. The carrdus school vat hike closure demonstrates how quickly these pressures can escalate.

Beyond the direct impact on parents, the new VAT policy created operational challenges for administrators attempting to forecast income and expenses for future academic years. Rising costs combined with unpredictable enrolment made the financial situation increasingly unstable. This made it harder for schools like Carrdus to maintain staffing, facilities, and long-term development plans, ultimately pushing them closer to closure when the pressures became insurmountable.

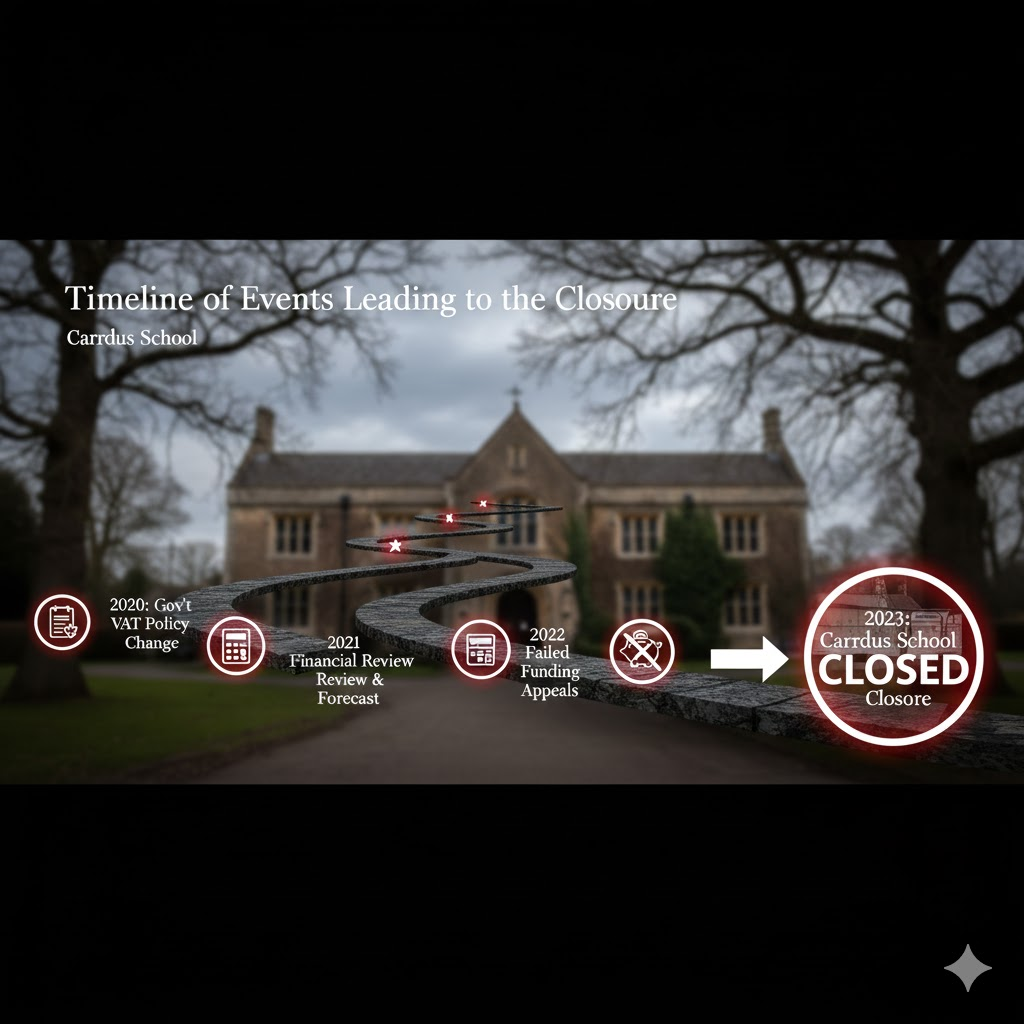

Timeline of Events Leading to the Closure

In the months leading up to the announcement, communication from the school grew noticeably urgent. Leaders attempted to reassure parents while actively exploring ways to stabilise finances, and many believed that a solution might still be found. However, when the final announcement was made, it revealed the true scale of the challenge. The carrdus school vat hike closure appeared sudden to many families, but internally the warning signs had been building for some time.

As the situation developed, the school reportedly pursued potential buyers, alternative funding sources, and restructuring strategies. Despite these efforts, no sustainable solution emerged. Parents were finally informed that the school would not reopen for the next academic year, marking a devastating end to a long tradition of independent education in the region.

Financial Breakdown: Why Carrdus School Could Not Survive the VAT Increase

Carrdus School faced a series of financial pressures well before the VAT hike was introduced, but the new tax amplified every existing challenge. Higher operating costs, ageing infrastructure, and fluctuating enrolment had already placed strain on the school’s resources. The introduction of VAT on fees acted as a decisive tipping point, reducing both parental affordability and the school’s financial resilience. As a result, the carrdus school vat hike closure became a matter of when, rather than if.

Although some argue that mismanagement also played a role, the financial data suggests that the school’s challenges were part of a wider national trend affecting smaller prep schools. Rising costs in staffing, energy, and maintenance placed long-term pressure on budgets, and the new VAT obligations accelerated the school’s financial decline. The closure therefore serves as a case study in how vulnerable certain independent schools are to sudden economic policy changes.

Community Reaction: Outrage, Shock and Rising Concerns

The emotional response to the closure was immediate and intense. Parents expressed frustration at the lack of early warning and felt the school could have done more to prepare for the financial challenges. Many questioned whether the carrdus school vat hike closure was truly unavoidable, or whether the school leadership should have been more transparent about the depth of the financial problems. Petitions, social media debates, and community statements followed rapidly after the announcement, reflecting widespread disappointment.

Teachers faced uncertainty and emotional distress as well, suddenly confronted with job losses and an unpredictable employment landscape. For many members of staff, the closure represented not only the end of a workplace but also the loss of a close-knit professional community. Local residents and councillors echoed these concerns, warning that the disappearance of such a beloved school could have long-term effects on the area’s identity and educational options.

What Happens to Students and Staff Now?

The immediate priority for families has been securing new school places, a process made more challenging by increased demand in nearby prep and state schools. Many schools in the surrounding area are already at capacity, creating an urgent situation for parents seeking continuity in their children’s education. The carrdus school vat hike closure has therefore intensified pressure on neighbouring institutions, reshaping the local admissions landscape.

For staff, the closure brought an abrupt end to long-term career plans. Experienced teachers, teaching assistants, and administrative workers suddenly found themselves navigating a competitive job market at short notice. The emotional stress of losing both employment and a strong school community has been substantial, and many are still searching for positions that offer stability and support.

Wider Impact on the Independent School Sector

Educational experts warn that the closure of Carrdus may be only the beginning for smaller independent schools across the UK. The carrdus school vat hike closure has become a reference point in national discussions about the viability of privately funded education under new financial demands. Many schools are already reviewing their long-term strategies, anticipating potential risks and preparing for similar pressures.

This shift could lead to a wave of mergers, restructures, or even additional closures as institutions adapt to a more challenging economic climate. Some analysts believe that the independent sector may undergo significant transformation in the coming years, with only the largest or most financially robust schools able to withstand rising costs.

Debates and Controversies: Is VAT Really to Blame?

A key controversy surrounding the closure centres on whether VAT alone was responsible. Some critics argue the school’s leadership may have relied too heavily on past successes without adapting to modern financial realities. This debate has grown particularly intense as families seek clear answers about why the carrdus school vat hike closure occurred despite attempts to secure additional funding.

Yet many parents maintain that the new tax on fees created an impossible financial environment for smaller schools. They argue that policymakers underestimated how deeply the changes would affect the independent sector, particularly in rural areas. This disagreement continues to shape political and educational conversations both locally and nationally.

Conclusion

The carrdus school vat hike closure stands as a powerful example of how government policy, economic pressures, and community expectations can collide with lasting consequences. While debate continues over the precise cause, the closure illustrates the vulnerability of smaller independent schools in a rapidly evolving financial climate. The loss of Carrdus School marks the end of an era for Oxfordshire and raises pressing questions about the future of the sector.