The uk state pension age retirement changes have become a significant concern for workers and retirees across the UK. These changes are designed to ensure the sustainability of the state pension system as life expectancy continues to rise. Understanding these shifts is essential for anyone planning their financial future, as they affect the age at which individuals can access government-provided pension benefits and how much they might receive.

These uk state pension age retirement changes are particularly relevant for those approaching retirement or who are in mid-career. By becoming familiar with the current rules, upcoming increases, and projected timelines, individuals can make informed decisions about saving, investing, and potentially deferring their pensions. Preparing early is crucial to maintaining a comfortable standard of living in retirement.

Understanding the UK State Pension System

The uk state pension age retirement changes are part of a broader framework that ensures financial support for individuals once they reach retirement. The state pension offers a reliable income, based on National Insurance contributions made throughout a person’s working life. There are two main types: the Basic State Pension and the New State Pension, each with distinct eligibility requirements and benefits, and understanding the differences is critical for effective planning.

Eligibility for the state pension depends on multiple factors, including age, contributions, and employment history. Self-employed workers, those with career breaks, or part-time employees may be impacted differently. Being aware of these factors allows people to plan strategically, ensuring they meet all requirements to qualify for the maximum state pension. These considerations are particularly important given the ongoing uk state pension age retirement changes.

Timeline of UK State Pension Age Retirement Changes

The uk state pension age retirement changes have already started to take effect for some individuals. The current state pension age is 66 for both men and women, set in 2020, and applies to those born before April 1960. This milestone is crucial for understanding when you can begin claiming benefits and how any delays might impact overall retirement income.

Looking ahead, the uk state pension age retirement changes will gradually increase to 67 between 2026 and 2028. Additionally, a further rise to 68 is planned between 2044 and 2046, although government reviews could accelerate this timetable. By understanding this timeline, individuals can make informed decisions about work, savings, and the potential benefits of deferring their pension to maximise income.

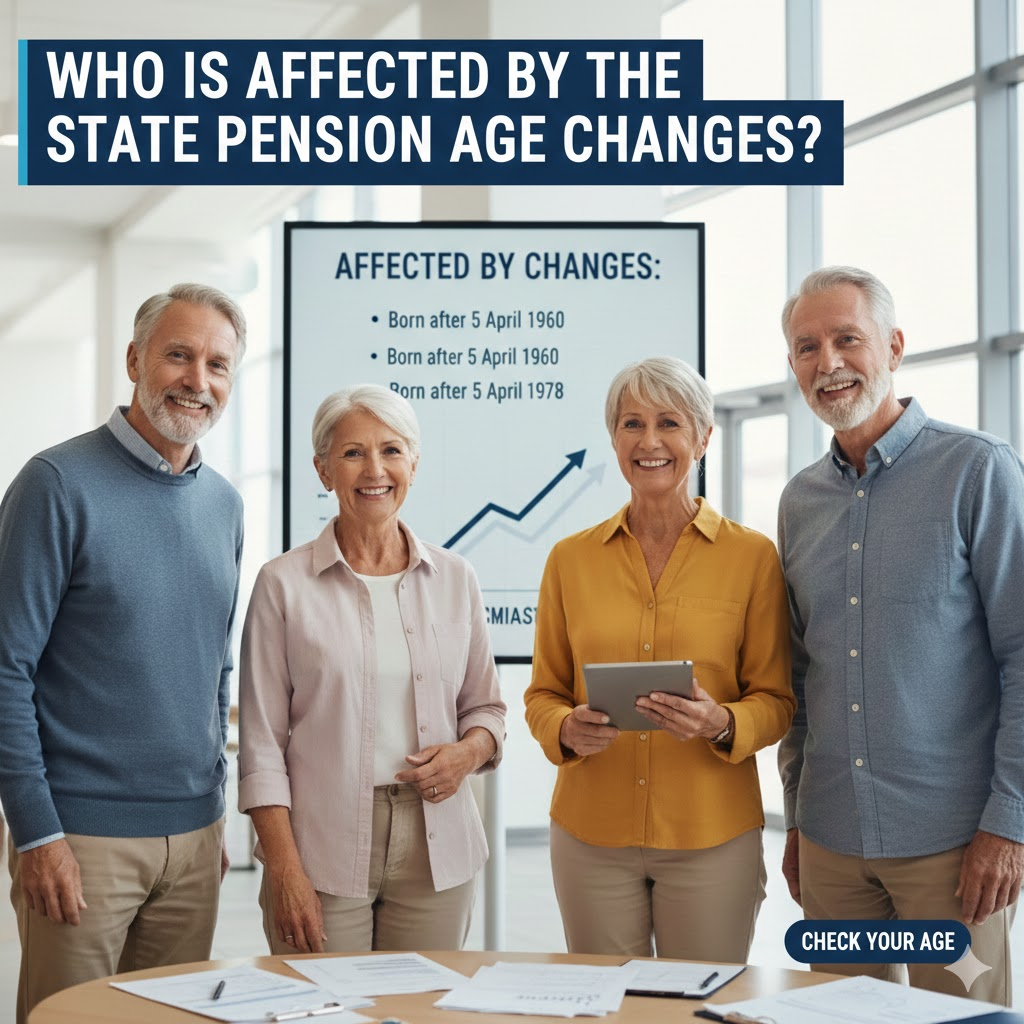

Who Is Affected by the State Pension Age Changes

The uk state pension age retirement changes impact different groups depending on their birth year. People born between April 1960 and March 1961 will experience a phased increase to 66 plus a few months. Those born from April 1961 to March 1977 are expected to reach the state pension age at 67, while people born after April 1977 may face an age of 68, though this is still under review.

Gender and employment history also influence how these changes affect individuals. Both men and women are now aligned in terms of pension age, but career breaks, part-time work, and self-employment may affect the total contributions recorded. Understanding how the uk state pension age retirement changes apply personally is critical to planning a secure financial future.

Why the UK State Pension Age Is Rising

The uk state pension age retirement changes are primarily driven by increasing life expectancy. As people live longer, pensions need to be sustainable over extended periods. By gradually raising the retirement age, the government aims to balance longevity with financial viability, ensuring that individuals can enjoy a secure income without putting undue strain on the pension system.

Economic and social factors also play a role. A higher retirement age encourages longer workforce participation, contributing to the economy while reducing the potential burden on public finances. These considerations explain why the uk state pension age retirement changes are necessary and why it is important for workers to understand and plan for these adjustments.

How to Plan for Retirement Amid the Changes

Planning for the uk state pension age retirement changes is essential to ensure financial security. One of the first steps is to use the GOV.UK State Pension calculator to determine your exact retirement age and expected pension amount. This provides clarity on when benefits begin and allows individuals to plan accordingly, including potential savings or private pension contributions.

Deferring the state pension can also be an effective strategy. By delaying payments, individuals can receive higher monthly benefits when they eventually claim their pension. Alongside personal savings, investments, and workplace pensions, these strategies help adapt to the uk state pension age retirement changes and support a stable, comfortable retirement lifestyle.

Conclusion

The uk state pension age retirement changes represent a significant shift in retirement planning across the UK. With phased increases to 67 by 2028 and eventual rises to 68, individuals must understand the timeline, who is affected, and how to adjust their retirement strategies. By planning ahead, checking eligibility, and considering deferral options, people can protect their financial security and ensure a comfortable retirement.