When people hear the name Jeremy Clarkson, they immediately think of Top Gear, fast cars, and controversial humor. However, behind the fame and success of one of Britain’s most well-known television personalities once stood a woman who played a pivotal role in shaping his life and career — Frances Cain. Though she prefers to live a private life, Frances Cain’s influence, business acumen, and dedication to her family have made her an intriguing personality in her own right.

In this detailed blog post, we’ll take a closer look at Frances Cain’s background, her life before and after her marriage to Jeremy Clarkson, her career achievements, and how she continues to make her mark quietly away from the limelight.

Who Is Frances Cain?

Frances Cain is a British television personality, talent manager, and businesswoman best known for being the ex-wife of Jeremy Clarkson — the outspoken presenter of Top Gear and The Grand Tour. But limiting her identity to being “Clarkson’s ex-wife” wouldn’t do justice to who she truly is.

Born and raised in England, Frances comes from a family with a strong military background. Her father, Robert Henry Cain, was a highly respected soldier and recipient of the Victoria Cross, the highest military honor awarded for bravery in the United Kingdom. This heritage of courage, discipline, and leadership is something Frances has often embodied in her own life.

Even before meeting Clarkson, Frances was known for her professional efficiency and organizational skills in the entertainment industry. She worked as Jeremy Clarkson’s manager in his early career days, helping him navigate the demanding world of British television — a role that significantly contributed to his eventual fame.

Frances Cain’s Early Life and Family Background

Frances Cain was born into a distinguished British family. Her father, Major Robert Henry Cain, became a national hero for his bravery during the Battle of Arnhem in World War II. He was awarded the Victoria Cross for his extraordinary courage under fire, and his story remains one of the most inspiring tales in British military history.

Growing up in such a household, Frances was influenced by values of integrity, resilience, and modesty. She received a good education and developed a strong sense of independence early in life. Friends and colleagues have often described her as a “grounded and capable woman” — traits that would later serve her well both personally and professionally.

Meeting Jeremy Clarkson: A Partnership That Defined an Era

Frances Cain first met Jeremy Clarkson in the late 1980s when she began working as his manager. At the time, Clarkson was still trying to establish himself in television journalism. Frances saw potential in him — his charisma, his confidence, and his undeniable passion for cars.

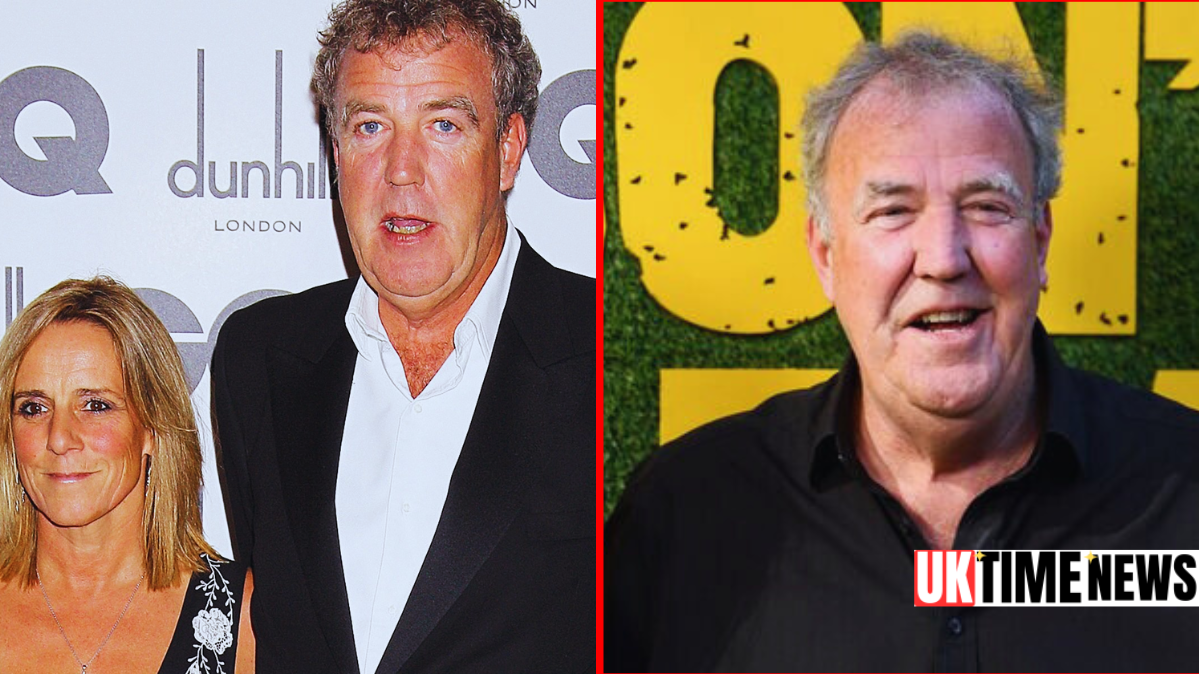

It was during this time that their professional relationship evolved into something deeper. The two began dating and eventually married in 1993. Their relationship became one of the most talked-about in British entertainment, not just because of Clarkson’s fame, but also because of Frances’s behind-the-scenes influence.

As his manager and later wife, Frances helped shape Clarkson’s public image and supported his rise to prominence. From Top Gear to The Sunday Times columns, Jeremy’s brand grew stronger, and many insiders credit Frances for her strategic thinking and emotional support.

Life as Jeremy Clarkson’s Wife

During their marriage, Frances Cain maintained a balance between family life and professional commitments. Despite being married to one of the UK’s most outspoken celebrities, she preferred to stay away from the limelight, focusing instead on raising their three children — Emily, Katya, and Finlo Clarkson.

The Clarksons lived in the Cotswolds, where Frances managed much of their household and family affairs. Jeremy often mentioned in interviews that his wife kept him grounded. She handled logistics, helped him stay organized, and provided the kind of emotional stability that his public persona often lacked.

An interesting detail often shared by fans of Top Gear is that Frances once gifted Jeremy a Ford GT, one of his dream cars. This gesture not only showcased her understanding of his passions but also highlighted her generosity and supportive nature.

However, life with a celebrity known for controversies and an unpredictable career wasn’t always easy. Despite the glamour, the pressures of fame and constant public scrutiny took a toll on their marriage over time.

Frances Cain and Jeremy Clarkson’s Divorce

After more than two decades of marriage, Frances Cain and Jeremy Clarkson decided to part ways in 2014. The divorce made headlines across British tabloids, with reports suggesting that Clarkson’s demanding lifestyle and controversies contributed to the split.

Though the separation was widely covered by the media, Frances maintained her dignity throughout. She refrained from engaging in public disputes or interviews, choosing instead to protect her privacy and her children’s well-being.

Many admirers praised her for handling the divorce gracefully. Unlike many high-profile separations, Frances avoided using the press as a platform for revenge or attention. She focused on rebuilding her life quietly, demonstrating remarkable resilience and maturity.

Following the divorce, she reportedly received a significant settlement, allowing her to continue living comfortably while dedicating her time to family and personal pursuits.

Life After Divorce: Frances Cain Today

Post-divorce, Frances Cain has largely stayed out of the public eye. She occasionally appears in social circles or is mentioned by her children on social media, but she seems to prefer a low-profile lifestyle.

Living in West Sussex, Frances enjoys outdoor activities such as cycling, horse riding, and spending time with her children. Her daughter, Emily Clarkson, has followed in her parents’ footsteps as a writer, blogger, and influencer. Emily often speaks fondly of her mother, describing her as “strong, kind, and wise.”

Despite not being active in television or media today, Frances’s influence continues to be felt through the success and public respect of her family.

While Jeremy Clarkson moved on with new projects like Clarkson’s Farm, Frances remained a symbol of grace and quiet strength — the woman who once stood behind one of Britain’s most famous broadcasters.

Frances Cain’s Professional Acumen

Though many know Frances for her marriage, her career accomplishments deserve recognition on their own. She began her professional journey as a talent manager, working with several media personalities. Her management skills were instrumental in helping Clarkson land career-defining opportunities.

Frances was known for her organizational ability, sharp instincts, and negotiation skills. These traits made her a respected figure behind the scenes of British television.

Even after stepping back from active management, her legacy as a business-minded woman remains strong. She has often been cited in industry discussions as an example of how crucial behind-the-scenes figures can be in shaping public success stories.

What Makes Frances Cain So Admirable

Frances Cain is admired not just for being the ex-wife of a celebrity but for embodying qualities that are rare in the entertainment world: grace, strength, and authenticity.

While many in her position might have pursued fame or public recognition, Frances consistently chose a quieter path. Her ability to stay composed during turbulent times — from media scrutiny to personal upheaval — speaks volumes about her character.

She represents a generation of women who built success through hard work, loyalty, and emotional intelligence rather than social media fame or public exposure.

Frances Cain’s Legacy

Frances Cain’s life story offers several valuable lessons. She reminds us that not every powerful figure stands in the spotlight — some operate behind it, shaping the paths of others.

Her legacy extends beyond her relationship with Jeremy Clarkson. It includes her contributions to his career, her devotion as a mother, and her quiet dignity in navigating public life.

In a media landscape that often celebrates controversy, Frances Cain’s story stands out as one of class, integrity, and strength.

Interesting Facts About Frances Cain

- She managed Jeremy Clarkson’s early career, helping him land Top Gear in the 1980s.

- Her father was a decorated war hero, Major Robert Henry Cain, who received the Victoria Cross.

- She is an avid cyclist and horse rider, often seen enjoying outdoor activities.

- She once bought Clarkson a Ford GT, one of his dream cars.

- She avoids social media, preferring to keep her personal life completely private.

Conclusion

Frances Cain may not be a household name like her former husband, but her influence on British entertainment and the people around her is undeniable. From her early days managing television talent to being a devoted wife and mother, she has lived a life defined by loyalty, grace, and quiet strength.

In an age where celebrity culture often values drama and exposure, Frances Cain’s story is a refreshing reminder that dignity, intelligence, and inner strength never go out of style.

Frequently Asked Questions (FAQ) About Frances Cain

1. Who is Frances Cain?

Frances Cain is a British talent manager and businesswoman best known as the former wife of television presenter Jeremy Clarkson. She was instrumental in managing his early career and has since maintained a private life.

2. What is Frances Cain’s background?

Frances comes from a military family — her father, Major Robert Henry Cain, received the Victoria Cross for his heroism during World War II. This background shaped her strong and disciplined character.

3. When did Frances Cain and Jeremy Clarkson divorce?

Frances Cain and Jeremy Clarkson divorced in 2014 after more than 20 years of marriage. Despite media attention, Frances handled the separation privately and respectfully.

4. Does Frances Cain have children?

Yes, Frances Cain and Jeremy Clarkson have three children together: Emily, Katya, and Finlo Clarkson. Their daughter Emily is a popular writer and influencer.

5. What does Frances Cain do now?

Frances leads a quiet life away from the spotlight in the UK. She enjoys outdoor activities and spending time with her family while maintaining her privacy.